Modernity

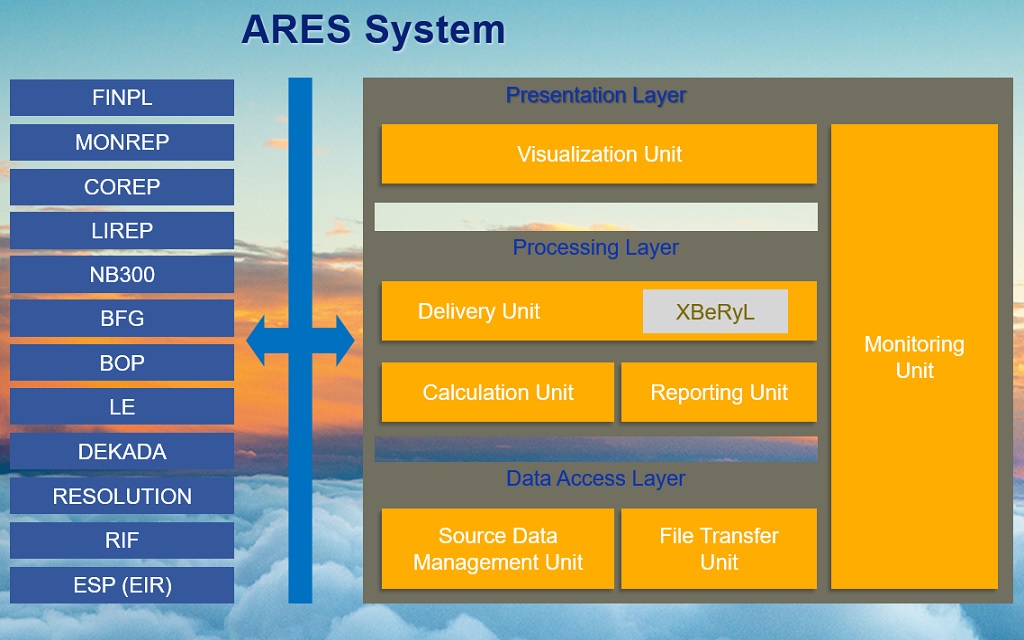

It uses three-layered architecture and it is very user-friendly and effective.

Modularity

Each type of reporting represents one dedicated module of the ARES SYSTEM which is establishing concerted functions of the whole platform and therefore expands the range of its operation by adding support and service for the specific requirements imposed on the particular reporting.

Implementation of the newest reporting or specialized modules takes place without any essential changes in the bank’s IT environment.

Homogeneity

Installation of the system on the server does not involve installing any extra software on the client’s stations in which result management of the system is easy and transparent.

Safety

Control of the availability of individual functions and types of reporting, (with the possibility to integrate Single Sign-On mechanism)

Efficiency

The highest effectiveness by dint of multi-layered contracts processing and using all of the available processes of the server.

Consistent user’s interface

The access to all of the functions and types of reporting is available from the simplest internet browser- therefore there is a possibility to switch between different modules without any additional logging into the System.

Report version control

Flexibility in preparing reports on historical data, thanks to the use of reporting versioning, as a response to changing legal regulations.

Collateral work

The faster implementation thanks to functionality of collateral work of many users of the same data.

Data import and export

Optimization of the direct database import with the possibility to provide any data from different databases.

Registration of actions

Saving information about all activity made by users

Modular architecture

System has a modular structure, it makes easier to implement and use the particular reporting packets. Each type of reporting corresponds to particular, dedicated module of the ARES SYSTEM (e.g. FINREP, MONREP, NB300) which uses the same IT infrastructure and functions of the whole reporting platform as well as expands the range of the actions, adding service of the specific requirements attached to specific reporting.